Autotax - GPS Mileage Logbook

AUSTRALIAN VERSION

Autotax provides Australian accountants and businesses the ability to track mileage and record vehicle expenses for tax purposes. The mileage log book app is ATO compliant and provides the app user with the ability to capture and upload their trip logs and vehicle expense reports as either a .CSV Excel spreadsheet file or PDF file.

The amazing benefit for Australian businesses and accountants using this mileage log book app are:

- Ability to allow your accountant to manage and export your data by accessing your data via our purpose-built accountant back-end control panel.

- Ability to download your trip log directly through the app and have it sent to you by email.

- Link your Dropbox account and automatically sync your reports with your Dropbox profile.

- Use your smartphone GPS to easily estimate the distance (KM) travelled per trip using GoogleMaps API.

- Record your toll roads usage (Australian toll roads included)

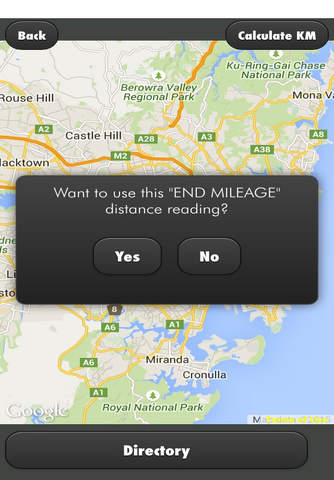

- Automated odometer tracking. No more start mileage data entry!

- Generate reports in Excel spreadsheet or PDF file

- Multiple vehicle fleet tracking with individual reporting

- Find out the estimated claim amount for each vehicle logged ($)

- Calculate the business use percentage (%)

- Use OCR scanning functionality to automatically read and upload your receipt data includes GST amount and Total amount

If youre looking for an app that provides fast and reliable data exporting when you need it the most then look no further and try Autotax for all your mileage log book and vehicle expense reporting needs.

The app is free to download but will require a small investment of $0.99 AUD per month to use the trip log and expense reporting functions. You also have the ability to purchase credits for the OCR receipt scanner functionality which allows you to upload scanned receipts and automatically take the total price ($) amount from the physical receipt and then transfer it into the data field of the app using ABBYY OCR technology. You can also purchase additional vehicles if you a have a fleet. We dont restrict how many vehicles you can add to make it easier for you to manage your vehicles. All transactions are secured by Apple.

Once, you have accumulated enough history (minimum 12 weeks required by ATO) you can make the maximum claim on your car expenses automatically and easily and best of all ATO tax compliant.

Continued use of GPS running in the background can dramatically decrease battery life.

We are always here to support you and are 100% Australian owned and operated by innospace solutions pty ltd.

For more information about this app please visit: http://www.autotax.com.au

For video tutorials visit: https://www.youtube.com/channel/UCHIROEf79lMId9m92PYNJQQ

For support email us: [email protected]

For any bugs or suggestions: [email protected]

We will be working on future releases so stay tuned!